In contrast to public perception, solar power just gets cheaper and cheaper. The price of some panels have fallen up to 28% in 2012, and most panels are becoming 3-5% cheaper each month.

The falling price of solar has nothing to do with the UK. Instead, it’s being driven by the appearance of huge new markets in Germany and Italy (p13 of link).

Bloomberg have identified a trend whereby the price of solar falls by 22% each time installed capacity doubles.

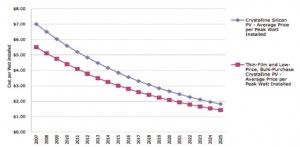

Yet recent declines are also part of a 20-year trend. Indeed, it’s possible to chart the falls in price: Bloomberg have noted that – for the last twenty years – every time solar capacity has doubled, the installed price of solar PV has fallen by 22%.

Using this anaylsis, it’s possible to work out where the cost will be in the future. By identifying how much capacity will be installed, we can extrapolate where this will leave the price.

Capacity

In 2011, 30,000 Mw of solar was installed globally (p43). Projections by the Euro Photovoltaic Industry Association expect between 20,000 Mw and 40,000MW to be installed in 2012, or between 66% and 133% increase in global capacity (same ref). Using Bloomberg’s model, this equates to 14% – 30% drop in installed solar prices this year.

Recently analytics provider IHS thinks that 2012 will see 31,000MW of solar installed, equivalent to a 111% increase, or a 24% installed price drop. IHS also thinks 34,000 of solar will go up in 2013, a 110% increase, implying a further 24% drop next year.

Module price is only part of the installed price

It’s also possible to look at the falling price of solar in another way. Most indices give an indication of module price – but that doesn’t directly translate into the price that it costs to get it on your roof. Indeed, for a domestic system the cost of the modules may only be 30-40% of the total cost.

That’s because – while module prices may fall – other costs – like scaffolding, labour, design, paperwork and the installer’s margin – may not.

Roughly, however, the relationship between module prices and install price is 2:1. i.e if module prices fall by 50%, install costs will fall by 25%.

So where does this leave our all-important installed price? Using our 2:1 metric, if the module cost reductions continue on current levels (there are good reason why they will, at least in the short term), we could see a further 18-30% reduction in installed cost next year.

This is backed up by industry data. For example the average price of installed solar in the US decreased 17.2% from Q1 2011 to Q1 2012:

Similarly in Germany, the price of solar fell by 4.3% between q2 and q3 this year, implying a 17.2% annual decrease.

So we have two methods of analysing price, and two industry examples – all of which point to yearly price falls of 18-30% for installed solar PV.

Of course none of this helps in the desperate situation of UK solar installers, many of whom are going out business due to lack of UK demand. However, as price falls UK demand will pick up, and installers are likely to have a better time in the near future.