A recent fire at the UK-France IFA Interconnector knocked out 1000MW of electricity coming into the UK

With media attention focused on soaring domestic energy bills, for business consumers prices are even higher – with more to come.

The full impact of recent price rises is not felt by domestic customers as their bills are capped by the regulator OFGEM.

But schools, colleges, academies, factories and businesses – the type of organisation that we deal with at BEC – are fully exposed to the wild volatility of the electricity market. And they are seeing its true effects.

Over the past few months, wholesale electricity prices have in some cases tripled. That means organisations can be paying tens of thousands – sometimes hundreds of thousands – more than they were this time last year, for the equivalent power. Those renewing electricity contracts in the current environment are paying 20-22 p per kWh, or even 25p; compared to the circa 15p they were paying this time last year (and the rate that domestic consumers pay).

So where is this all going? Is this a blip, or is it going to last?

Prices are Rocketing in the the Wholesale Electricity Market

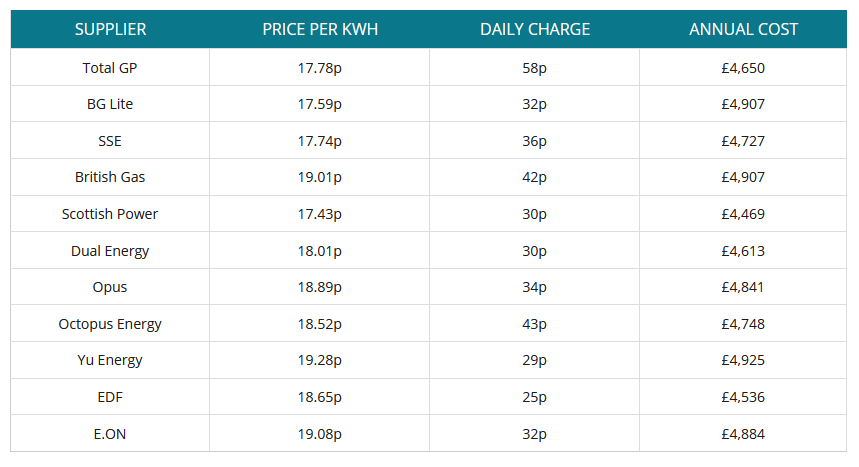

Retail business electricity rates at 5th July 2021 – source – https://www.businesselectricityprices.org.uk/

One way of looking at this is by looking at the wholesale market. Electricity is traded, and forward prices of the wholesale market (where BEC sells our solar electricity) give an indication of energy prices to come.

When we contact electricity buyers, they offer us different prices based on different contract lengths.

For many years we were offered around 5p per kWh. Suppliers then add grid fees, payments for renewable subsidies, profit margins etc, which translated into a ‘factory gate’ price of around 14p kWh.

But recently wholesale prices have spiked. Last week I was offered the following wholesale prices for BEC’s solar electricity:

- 17p per kWh for a six month contract (translating to a ‘Factory Gate’ price of around 24-26p per kWh)

- 12p per kWh for a one-year contract (translating to a rate of around 21-23p per kWh)

- 7p per kWh for a five-year contract (translating to 16-18p per kWh)

As you can see, this would imply that even at the longest term contract, commercial electricity prices are up by 10-20% for five years, at the very minimum.

Will Electricity Prices Continue to Rise?

There are many structural reasons that electricity prices are high at the moment, some short term, and others longer.

Short term, there are some well-documented problems in the electricity system. There’s a lack of gas, the France-UK IFA inter connector had a fire, some nuclear power stations are partly shut for maintenance; and there’s been remarkably little wind of late, so offshore wind farms have been still.

This much is well known. What is not more widely discussed are more long term headwinds. These are likely to continue to push up electricity prices in the medium term:

- The nuclear industry has been promised a subsidy of 9.2p per kWh for electricity generated from the new nuclear power station at Hinkley Point C. Since Hinkley will generate about 10% of UK electricity that will add perhaps 0.5p per kWh to all electricity bills, for 35 years.It’s also worth noting that subsidies for new wind farms (via the Contracts for Difference mechanism) have started showing up on commercial electricity bills of late (adding another 0.5p or so). And the Climate Change Levy (CCL) is similarly paid by business consumers, adding yet another 0.5p or so (although since registering with the CCL scheme is voluntary most organisations haven’t bothered).

- Global gas supply is down since Covid as US fracking has tumbled. The number of fracking rigs in operation in the US is roughly at half of its peak in 2019. That has taken a huge amount of gas out of global supply, so it’s more expensive to generate power at gas-fired power stations (about half of UK electricity generation).Again, this is likely to persist as US frackers can’t get finance as financial markets wake up to their role within the climate emergency. It’s also a large problem for the UK’s largest plastics producer INEOS (headed by the UK’s richest man, Monaco-based Jim Ratcliffe), which loudly trumpets the use of US fracked gas in its operations.

- Electrification of transport will require a 10-100% increase in the amount of electricity required nationwide, (depending on who you ask) Without additional electricity generation, this will push up the wholesale electricity price further.That’s not to mention the electrification of heat – converting the housing stock away from gas to heat pumps will put an additional burden on the price of electricity.

High Electricity Prices increase the case for Renewables

Of course, there’s a straightforward solution to this – build more renewables. Putting solar on your roof effectively takes you partially ‘off grid’ and away from the vagaries of the electricity market. Prices for solar installations have fallen by around 20% over the last few years, and indeed there’s something of a solar boom going on as local authorities roll out solar on their buildings paid for by government grants.

High wholesale prices also increase the investment case of solar organisations, since we are suddenly getting more cash for the power we input into the grid. See here for the impact on solar farm operator Foresight.

Additionally, you might follow some of the eminently sensible demands of Insulate Britain and reduce energy use overall.

Come on Boris, get on with it!

Brighton Energy Coop offers match-funded solar grants for small businesses, helping them go solar. Check out the details here