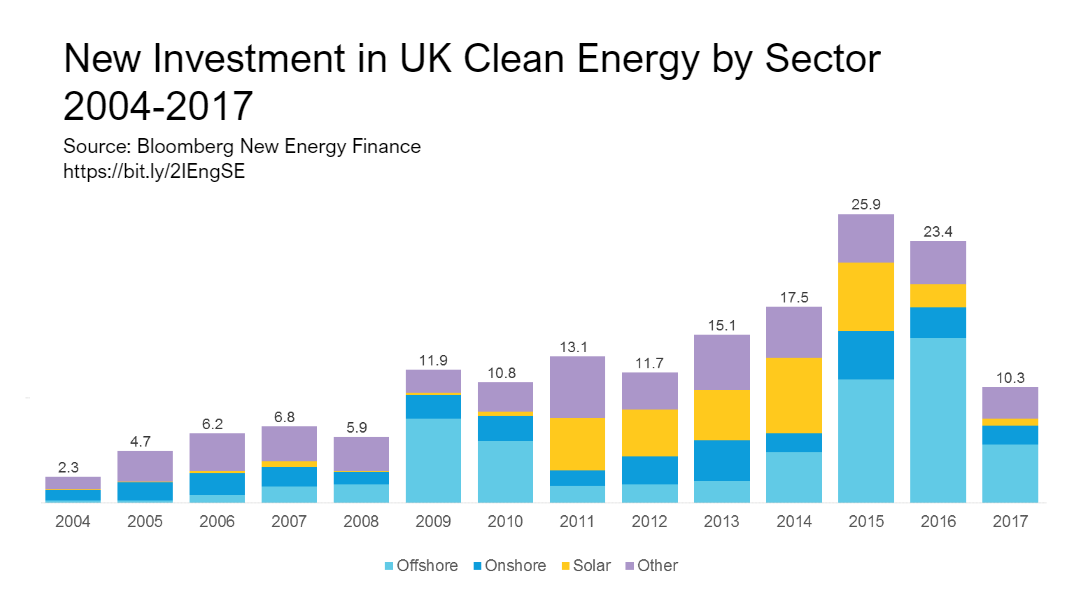

The UK has suffered a ‘dramatic and worrying collapse’ in clean energy investment, according to MPs. In cash terms, investment in clean energy fell by 10% in 2016 and then 56% in 2017.

The UK has suffered a ‘dramatic and worrying collapse’ in clean energy investment, according to MPs. In cash terms, investment in clean energy fell by 10% in 2016 and then 56% in 2017.

The House of Commons Enviromental Audit Select Committee said: “Annual clean energy investment in the UK is now the lowest it has been since 2008.” That’s two years before the feed in tariff scheme was introduced.

After rising each year between 2011 and 2015, investment in the largest renewable sector – offshore wind – peaked in 2016 and then collapsed by more than 60% last year.

Solar suffered a similar trajectory, with investment peaking in 2015 and then falling significantly for the last two years, while investment in onshore wind has tended to increase and then fall back almost every two years.

Here at Brighton Energy Coop we are regularly about barriers to clean energy development. While there are many answers to this, it’s now obvious where the number one obstalce lies: the Conservative government.

This administration has:

– Reduced Feed in tariffs to the point where most people see small renewables as economically unviable

– Halted the development of solar farms via the removal of the Renewable Obligation scheme

– Removed renewables’ eligibility for Venture Capital Trusts and the Enterprise Investment Scheme

– Removed the Climate Change Levy (CCL) exemption for renewables

– Implemented as a host of minor regulatory measures in an ongoing regulatory war of attrition against clean energy development.

The Chair of the Select Committee called for the government

“to secure the investment required to meet the UK’s climate change targets.”

Fine words.

But the reality is that the government has showed continual, predictable and – dare I say it – strong and stable – signals throughout its two terms that it is hostile to renewable energy.

In 2016 the Committee noted:

“…the Treasury had ridden roughshod over other department’s objectives, changing and cancelling long-established environmental policies and projects at short notice with little or no consultation with relevant businesses and industries. These decisions caused ‘shock’ and ‘uproar’ among sectors affected, with some businesses describing them as ‘devastating’.”

It’s no surprise that investors are not convinced.