Ethical Investing – Investing for Positive Impact

Ethical investors put money where it does some good. Yet investing ethically is a broad church. The range of investment choices is large, from mutual funds to crowd funding projects and community energy. A useful benchmark for responsible investments is – do you really know what is being invested in?

Exchange-Traded Funds – what exactly are their ethical preferences?

Ethical exchange-traded funds offer various financial investments which are supposed to be ‘ethical’. There’s been a lot of talk in the last few years about ESG funds (the ESG bit stands for Environmental, Social, and Governance, where the focus of the investment is supposed to be). These funds are at the forefront of money flowing towards climate change-related investing

A major issue around this sort of fund is how to define the ‘ethical’ bit. Some ethical funds promote themselves as heroes of ESG investing because they put money in Tesco, say, as opposed to obviously unethical companies such as BP. Rather than a positive investment this is more like a neutral position – it’s just putting money where it does less harm. It’s a careful distinction, but it’s not really a positive investment decision – it’s just an investment that doesn’t really do anything.

Ethical Investment Advisors & Fund Managers – unimaginative sustainable investments

This sort of approach to sustainable investing is also common to ethical investment advisors. He or she is highly regulated and in order not to contravene the rules, they may decide only to advise shares that are in the FTSE 100, for example. Again, if there are no clear choices on what to invest in that does some good, the ethical investment advisor may come down on suggestions that do the least harm: hardly a progressive way to make ethical investment decisions.

In general, ethical investment funds and advisors are likely to deliver only a mildly ethical investing options.

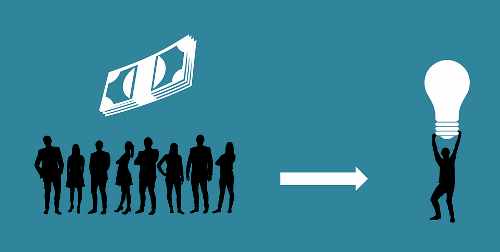

Crowd-funding ethical investment

If you’re looking to be a bit more proactive with your money, the good news is that new investment platforms has changed the investment industry. Your options are now much more diverse. With the rise of crowd-funding it’s now much easier to identify investment in businesses that do simple good, without just being the best option in the face of a multiple of bad choices.

Ethical investment and Clean Energy – Impact investing for individual investors

One sector within the crowd-funding secor is Community Energy. Community energy investment – which usually involves some sort of renewable energy technology – has the advantage that the environmental impact, business practices and corporate governance practices are clear. You could probably even pop down to their office.

Any renewable energy investment is a positive choice, but community energy is also making a positive choice about who owns a fundamental part of our economy.

There are several hundred community energy groups in the UK, all of which use crowd-funding to support their schemes. More than £350m has been invested in the UK this way. There are also various community energy platforms (like Ethex) that exist to support community energy funding.

Conclusion – Small Companies are a better place to invest for social impact

For clarity about socially responsible investing, fossil fuel companies and ‘sin stocks’ are an easy avoid. ESG factors may have cleaned up investments in financial institutions – to a degree. But the innate tendency of financial markets to divert everything towards the cause of making money means they are simply not trustable.

Rather than having to take a deep dive into the financial and operations of large, obscure entities, small is beautiful. In recent years many of these small operations have a financial return and have developed a solid past performance.

Steer clear of the big guys – the best investment selection to build and ethical investment portfolio (especially for the first time investor) is via the multitude of small energy schemes; responsible companies whose long term ethical principles are clear.