The good ship UK solar recently sailed into a storm of uncertainty as the government proposed slashing subsidies to renewable support schemes.

The good ship UK solar recently sailed into a storm of uncertainty as the government proposed slashing subsidies to renewable support schemes.

After enduring the punishing headwinds of continual reviews (the current FIT review is the the fourth in four years), the sector has – at the very least – been tossed about on a rip tide of rule changes and uncertainty as new regulations have risen from the deep, old ones have morphed, and sudden deadlines have been imposed.

At the very least this illustrates the government’s animosity towards renewable energy. Last week the head of the British Photovoltaic Association (BPVA) published notes of meeting in which the secretary of state for Energy – Amber Rudd – told him that job losses in the sector were of no consequence on the thinking of the department with regard to future FITs. A stark contrast, then, to the always-highlighted jobs produced by the various subsidies that support the oil and gas sector, or the great white elephant that is the new nuclear power station at Hinkley Point.

How will this affect the future of solar PV?

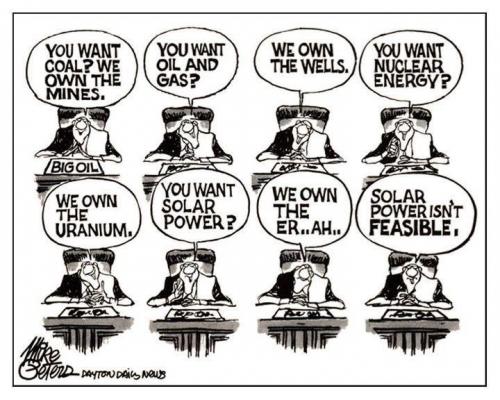

And yet the government’s pigheadedness towards renewable energy is just something we will have to deal with. Indeed, as the cartoon above illustrates, it’s simply a consequence of the vested interests that exist within the UK government

So let’s look and see what can be done. Certainly things like emailing your MP to support solar will be a great help; or follow #saveoursolar on twitter for updates

But understanding the business case can also be enlightening. FIT cuts of 87% are obviously not great. But is it realistic to think that costs can be cut to accommodate such change? If so, then we might be in a wonderful position: getting the government completely out of our hair in the next few years.

Cutting costs to accommodate falling FITs

There are various bits to a solar PV system. There’s the hardware, obviously. Since solar PV exists in a global market, hardware costs are pretty much the same the world over. While PV costs are declining at 5-10% per year, that is far below the 60% mentioned above.

Another aspect is more nebulous. ‘Balance of system’ costs are things like labour, installation margins and project development costs.

While there is very little evidence how balance of system costs are changing – if anyone has any it’d be gratefully appreciated here at BEC! – there is a strange anomaly in UK Solar that no-one is really able to explain: why the installation costs of German PV are 20-30% lower than that of the UK. To me this indicates that there are margins within the industry that can be cut, although solar installers are unlikely to welcome me saying that.

Financing – who’s been making the money

Finally, and perhaps most importantly, there is the cost of raising the money. Typically this is not looked at as a cost – the returns on investment are calculated after costs are subtracted from revenue. However, effectively returns are an operating cost – an inbuilt margin without which the money is not provided to the system in the first place. A certain percentage must be delivered for whatever money mechanism is providing the cash.

Here, UK solar has been seriously gorging itself. The UK solar market was the largest in Europe in 2014, racking up 60% year on year increases in 2013 and 2014 (see p9 of this).

You can be sure this was not because a rash of eco-minded philanthropists rushed to these shores. Nor was it because of the increasing rise of valiant community energy schemes. No: the reason for this impressive increase was simple: there was pots of cash to be made.

The people who provide the money – this varies greatly from finance houses in the City of London to individual home owners – have been chomping away at fat returns – especially with solar farms – for several years. Returns have hit 15% – or even higher – for some projects (see an example here).

Alright – it can be argued that you need a certain level of cash-to-be-made to get the money in the first place. How much is a vexed question. UK Solar’s Captain at arms – Amber Rudd – appears to think 4% is appropriate. Since Amber is an ex investment banker you’d think she knew better than that.

What next?

Can reductions in kit costs, balance of system costs, and returns to investors make projects viable once new FITs come into effect?

The reality is that no-one knows.

One thing is for sure: UK solar PV will be thrown into disarray for several months after January 1st 2015 (when the tariff changes come into effect).

Friends of the Earth reckon that 20,000 stand to lose their jobs, as hundreds of installation companies go bust.

Prices will inevitably drop, and financing will disappear from the sector.

Will that leave a viable solar market? It’s impossible to say. But there is, however, a glimmer of hope. Those of us that recall the 60% FIT cuts of 2012 will note that within 6 months prices had fallen to make projects viable again (BEC’s first project sailed in this particular solar storm).

That is presuming, however, that the government doesn’t scrap the sector altogether, regardless of any FIT review, as they have threatened.

Onwards!